Recent Articles

- IRS Taxpayer Advocate Service Relases its 2016 Annual Report to Congress January 11, 2017

- Year-end Tax Planning for Small Businesses December 6, 2016

- IRS Small Business and Self-Employed Tax Center August 26, 2014

- New 1023-EZ Form Makes Applying for 501(c)(3) Tax-Exempt Status Easier; Most Charities Qualify July 3, 2014

- DO THE TOP 1% PAY ENOUGH TAXES? TOO MUCH? June 18, 2014

- IRS Adopts “Taxpayer Bill of Rights” June 17, 2014

- $100,000 Income: Three very different tax bills May 1, 2013

- IRS eyes new ways to tax miles of frequent fliers May 1, 2013

Featured Posts

New 1023-EZ Form Makes Applying for 501(c)(3) Tax-Exempt Status Easier; Most Charities Qualify

On July 1, 2014, the Internal Revenue Service introduced a new, shorter application form to help small charities apply for 501(c)(3) tax-exempt status more easily. The new Form 1023-EZ, available today on IRS.gov, is three pages long, compared with the standard 26-page Form 1023. Most small organizations, including as many as 70 percent of […]

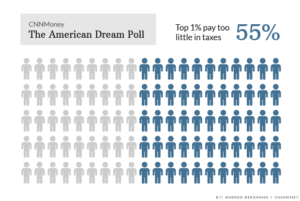

DO THE TOP 1% PAY ENOUGH TAXES? TOO MUCH?

The top 1% of households pay too little in taxes. That’s the opinion of 55% of people surveyed in CNNMoney’s American Dream poll. More women (61%) than men (49%) held that view. And not surprisingly, so did more Democrats (77%) than Republicans (33%). Straddling the middle were independents, 52% of whom thought the tax burden […]

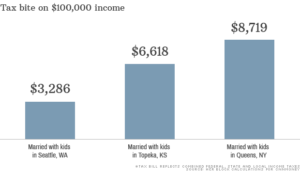

$100,000 Income: Three very different tax bills

$100,000 Income: Three very different tax bills There are a lot of differences between Queens, N.Y., Topeka, Kan., and Seattle. One that stands out: People making the same money in each of those places can face very different tax bills. CNNMoney asked the Tax Institute of H&R Block to compare the combined federal, state and […]